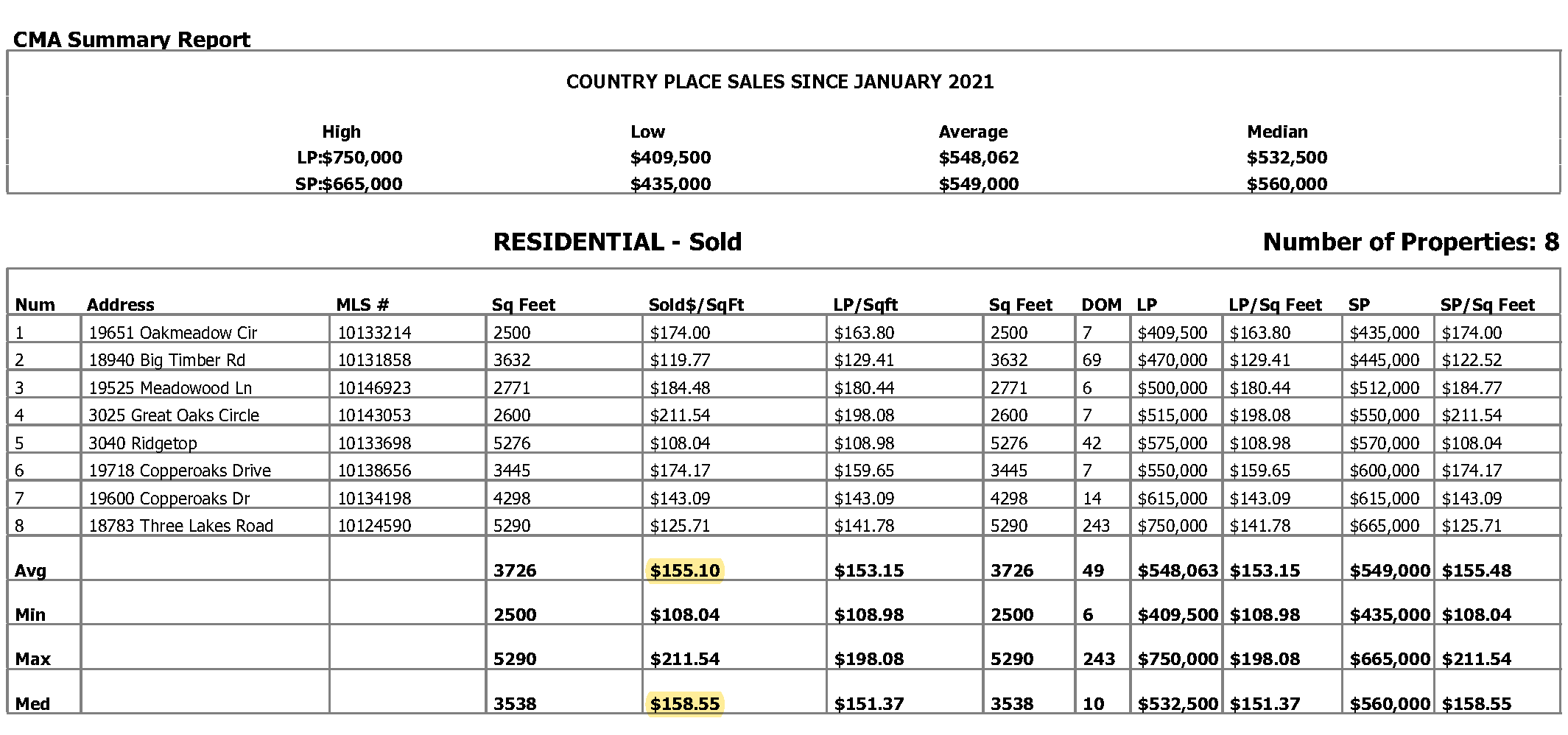

I had a call on Saturday from a friend who had received her property tax notice. She was upset, near tears, because her home’s value had been more than doubled in the past year. While hers is an unusual case, I have spoken to several neighbors whose appraisals appreciated by 15-30%. If you are planning to protest your appraisal, you may want to take a look at this page and take a moment to look at the data behind these increases. (The document can be downloaded here: 2022-04-30_Country Place Comps.)

If you look at the average and median numbers above (highlighted in yellow), you’ll see that the list price is lower than the sold price. These sales include several homes in need of extensive repairs and/or updates.

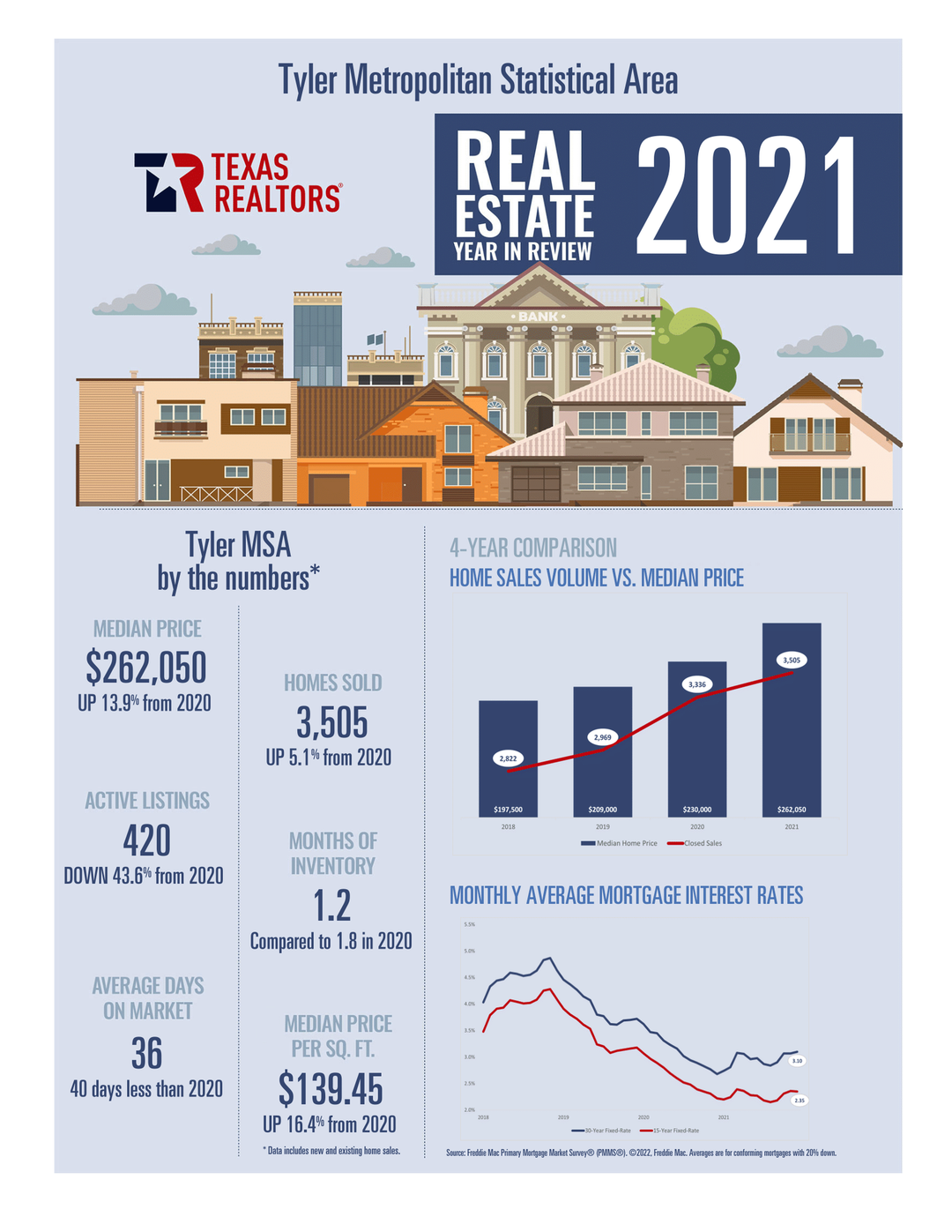

While Tyler’s numbers aren’t as dramatic as Austin’s (median price now at $499,995), they are unprecedented for East Texas, where home prices have typically increased 3-5% a year. In the infographic below, you can see that 2021 saw an almost 14% increase in the median price of a Tyler home.

With the big wave of metropolitan and blue-state refugees flooding into our area, Smith County is going to have a hard time expanding the infrastructure to accommodate all this growth, so they are being aggressive with property taxes.

Speak Your Mind

You must be logged in to post a comment.